SJP Protection planning

What is financial protection and why do I need it?

When thinking about financial protection it is about covering yourself and your family in the event of accident, illness and death. It’s about asking those ‘what if’ questions:

- What would happen if you couldn’t work due to illness?

- What would happen if you had a critical illness?

- What would happen if you were to die?

And then following on one step further in terms of ‘could you survive financially if that happened?’

- If you were unable to work due to illness and you had no sick pay from your employer, could you continue to pay your bills?

- Could your family survive without your earnings in the event of your death?

Income protection

What does it do?

Income Protection provides a tax-free income in the event of you being unable to work due to an accident or any illness that stops you working. It is designed to replace part of your loss of earnings and there are many different options on this. You can choose how long it takes before this protection kicks in; you can choose how long it continues to pay out to. Most income protection policies are very long term, and they will actually pay out until you either return to work, you reach retirement age or you die.

Why might I need it?

Income Protection can provide the money to cover your essential bills whilst you are not earning and also cover your standard of living if required. Therefore, if you are reliant on your income to pay your bills, to feed yourself and your family, and to maintain your lifestyle, then this is something you should consider.

Who doesn’t need it?

The first thing to take into account is what your employer’s sick pay is. If you have any sick pay through your employer then you don’t want to duplicate that with an Income Protection Plan. Generally, you would set income protection up to start when your employer’s sick pay finishes. Again, this is protecting you for your benefit so it is a must for anyone who doesn’t have enough financial means elsewhere or enough sick pay through your employer. If you are not reliant on your income or your income would continue even if you couldn’t work then you don’t require Income Protection.

What might I pay?

The table below looks at how key details such as the sum assured, the deferred period and the term of the policy can impact the amount you might pay each month.

| Age in years | Sum assured per month | Term in years | Deferred period in weeks | Full income protection cover monthly premium | 2 year short-term pay-out monthly premium |

| 30 | £1,500 | To age 65 | 4 | £26.37 | £11.97 |

| 30 | £1,500 | To age 65 | 8 | £20.48 | £9.39 |

| 30 | £1,500 | To age 65 | 13 | £15.87 | £5.54 |

| 30 | £1,500 | To age 65 | 26 | £14.24 | £5.88 |

Please note that any premiums mentioned are indicative only and based on this specific case study/ example, which is shown for information purposes only. Premiums shown are an average of the 5 cheapest insurers. Your own circumstances will determine whether the amount payable is more or less than the figure quoted.

Based upon a male, non-smoker.

Quotes provided August 2024

Critical illness cover

What does it do?

Critical Illness cover provides a lump sum in the event of you being diagnosed with one of the illnesses listed on the policy document.

Why might I need it?

Typically, Critical Illness cover is taken out to cover a mortgage or a debt so that it can be cleared in the event of you being diagnosed with a critical illness. Critical Illness cover can also provide a lump sum to allow your partner to take some time off work if you were diagnosed with a critical illness or to provide money for alterations to the home if you had a critical illness requiring wheelchair access or similar or to pay for medical treatment should you wish to do that.

Who doesn’t need it?

We are all in danger of being diagnosed with a critical illness and because it pays out to you if you get critically ill generally the only people that don’t need Critical Illness cover are those people that have enough means elsewhere and would be ok without this financial safety net.

What might I pay?

The table below helps to give you an idea of monthly premiums for stand-alone critical illness cover.

| Age of client in years | Sum assured in £s | Term | Type of cover | Monthly premiums in £s |

| 30 | £30k | To age 65 | Level critical illness only | £10.53 |

| 30 | £100k | To age 65 | Level critical illness only | £30.20 |

| 30 | £30k | To age 65 | Level critical illness only | £15.23 |

| 30 | £100k | To age 65 | Level critical illness only | £44.37 |

| 30 | £30k | To age 65 | Level critical illness only | £24.96 |

| 30 | £100k | To age 65 | Level critical illness only | £77.52 |

Please note that any premiums mentioned are indicative only and based on this specific case study/ example, which is shown for information purposes only. Premiums shown are an average of the 5 cheapest insurers. Your own circumstances will determine whether the amount payable is more or less than the figure quoted.

Quotes based on male, non-smoker, to age 65

Quotes provided August 2024.

Life cover

What does it do?

Life cover provides a lump sum (or an income for a fixed period) in the event of your death during the term of the policy.

Why might I need it?

Typically, life cover is taken out to clear a mortgage or other debt in the event of death.

However, it can also be useful when you have children or other dependants and they are reliant on your earnings, not just to pay a mortgage or debt, but to feed and clothe them and pay the household bills

Who doesn’t need it?

Life cover isn’t needed by people who don’t have any dependants. If you live alone and your house could be sold without anyone becoming homeless, in the event of your death then you don’t need life cover. You can however, still take out life cover if you wish.

What might I pay?

The example below demonstrates what your monthly premiums could be for level term insurance by age and sum insured.

| Age in years | Sum assured in £s | Term in years | Monthly premium in £s |

| 32 | £500k | 30 | £15.86 |

| 32 | £300k | 30 | £11.37 |

| 45 | £500k | 30 | £50.94 |

| 45 | £300k | 30 | £32.49 |

Please note that any monthly premiums mentioned are indicative only and based on this specific case study/ example, which is shown for information purposes only. The monthly premiums shown are an average of the 5 cheapest insurers. Your own circumstances will determine whether the amount payable is more or less than the figure quoted.

Quotes based on a male non-smoker rates.

Quotes provided August 2024.

Protection planning team

Your adviser may choose to focus their time and expertise on other aspects of your financial advice, but for the St. James’s Place Protection Planning team protection is all we do. That’s why if a protection need has been identified during your conversation and you have confirmed you would like to explore this further, your adviser may choose to refer you to us.

The St. James’s Place Protection Planning team is a referral service designed to support your adviser with protection. We offer a telephone-based advice service with the sole purpose of providing advice on and setting up protection policies.

We specialise in arranging life, critical illness and income protection cover on a personal and business basis.

St. James’s Place Protection Planning is a trading name of Future Proof Ltd.

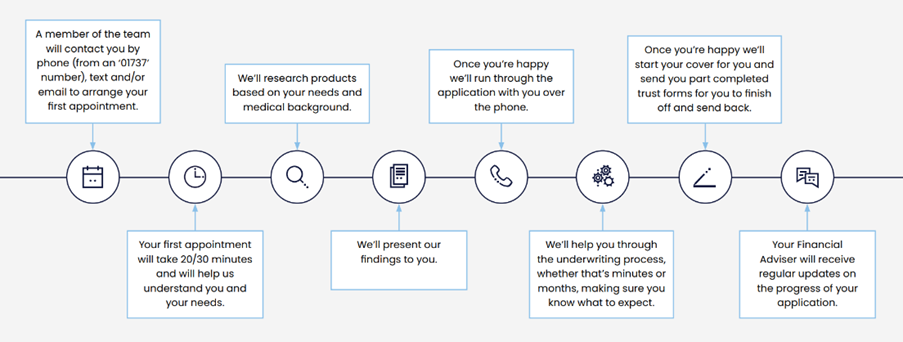

Your journey

If you are happy to discuss your protection needs with St. James’s Place Protection Planning this is what you can expect to happen:

- Protection is all we do therefore, we truly are specialists in our subject matter.

- Where possible, we will not use industry jargon in our conversations with you.

- We ensure the cover is set up correctly at the outset - meaning fewer delays if you need to make a claim.

- We can help you to put your policies in Trust – at no additional cost – ensuring that upon death the right money gets into the right hands at the right time.

- A dedicated adviser will be with you from start to finish.

- We’ll explain what comprehensive cover looks like in comparison to more basic plans.

Trusts are not regulated by the Financial Conduct Authority.

Speak to your SJP Partner today for more information or click here to find a financial adviser near you.